Wrangler has announced it will roll out a special line of jeans from sustainable cotton farmers in five states. McClendon Acres, an 8500-acre cotton, peanut, and corn farm in Leary, has been chosen as the Georgia supplier for the Wrangler Rooted collection.

The Black Sheep of Climate Change

There's a good interview at NPR's The Salt with Chris Clayton, ag and policy reporter with DTN/The Progressive Farmer, who has become the Cassandra of climate change in the farming community. For those unfamiliar with the general attitude about the subject inside agriculture, it should be an informative read. The impolitic rollout of the Waters of the U.S. (WOTUS) rule by the Obama EPA will have lasting cultural effects among farmers and their perception of government regulations and agency overreach. There's a treatise on energized elitism in that.

But producers who do not embrace climate change as a reality are taking a dangerous and, sometimes, outright fatuous position. In the first place, planning for environmental variability and thinking long-term about water availability are simply good risk management strategies. The bigger issue is the lost opportunity for farmers to portray themselves as a solution to climatic disruption. If they push the narrative that conscientious farming can sequester carbon, limit emissions, and lead to cleaner water, it's a marketing coup. But it also might lead, eventually, to policy that puts money in their pockets for building soil and the productive quality of their farms.

It's fascinating and nearly unbelievable to read that, 20 year ago, American Farm Bureau was a primary advocate of cap-and-trade carbon policy:

“During the Clinton administration, Farm Bureau was really one of the leaders in helping pitch the concept of a cap-and-trade plan that also partially would have paid farmers for sequestering carbon in soil, using the kind of practices that build organic matter. Farm organizations helped pitch this idea to the Clinton administration. By the time you get around to the debate in 2009, Farm Bureau takes a very skeptical attitude, and then starts inviting some of the strongest climate critics to become speakers at its convention.”

Georgia's Drought Impacts Cattle Production

If you want to see a clear sign of the effects of the 2016 drought, look no further than livestock auction receipts for the week of November 11. Georgia cattlemen took 3,600 more cattle to the sale than they did during the same period in 2015. That's an increase of over 46 percent. For the year as a whole, 5,600 more head have hit the auction, obviously a large part of that coming in the latter half of the year as pastures quickly degraded.

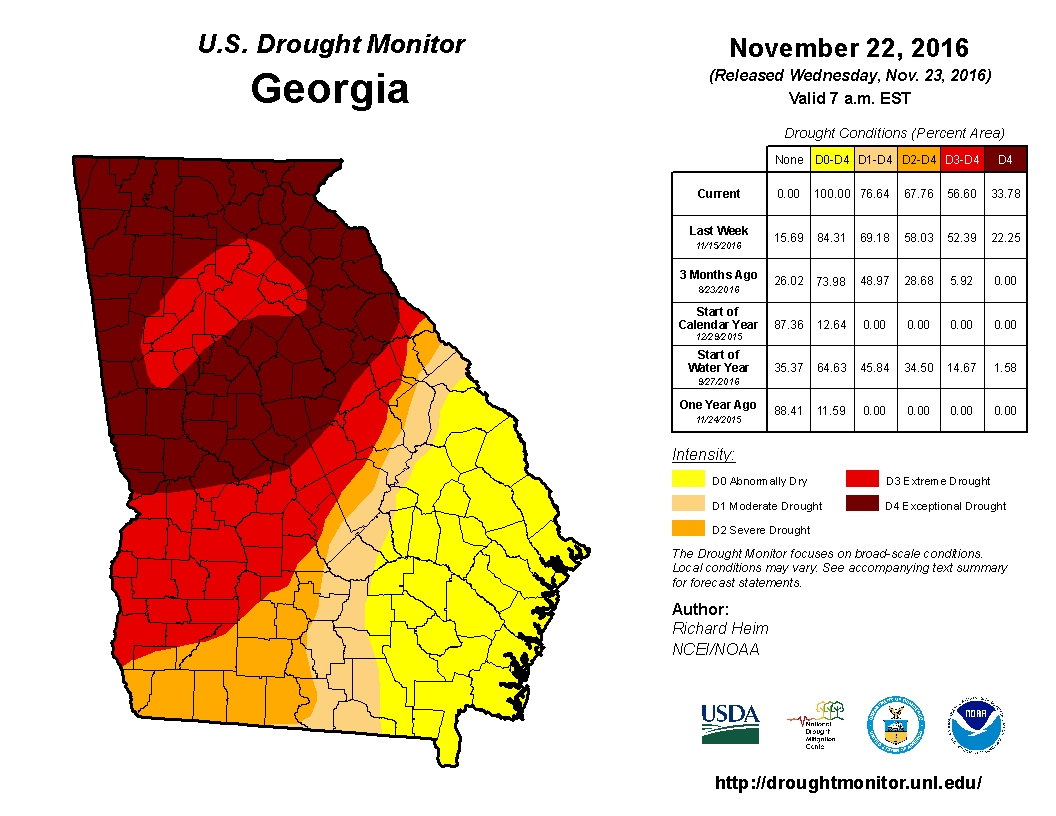

Chart, forage conditions, and November 22 drought map are below. Praise the Lord we've had some rain in December.

Cattle and Calves Receipts

Pasture Conditions Weed Ending 11/13/2016

U.S. bumper crops equal free-falling prices

No real surprises from the recent WSJ article on the production/price trends facing the major U.S. commodities. Farmers are realizing their second consecutive year of good weather and environmental factors that favor increased production. The USDA forecasts the current corn crop to reach about 13.86 billion bushels, which beggars belief since the estimate is not far off of 2013's record 13.93 billion bushel crop despite 11 percent more acreage devoted to soybeans in 2014.

In fact, American farmers planted corn on 91.6 million in 2014, 4 percent less than 2013, according to USDA NASS. However, the agency estimates a record 84.8 million acres planted in soybeans, as producers went looking for demand following 2013's robust corn output. Of course, this shift en masse has led to the same kind of downward pressure on soybeans that has afflicted corn. U.S. soybean producers also face stiff competition from Brazil, which saw an 8 percent increase in exports (read China) through May 2014.

As of July 25, 2014, future prices on the Chicago Board of Trade were around $3.63 for the September corn contract and $12.12 for the August soybean contract. With break-even points generally running $4 and $10.00-$11.50 per bushel for corn and soybeans, respectively, the nation's corn farmers "will likely fail to cover their costs for the first time since 2006, according to agricultural economists."

“But the slide in corn prices is expected to cut sharply into overall incomes in the U.S. Farm Belt because corn is the country’s largest crop, grown on 350,000 farms and yielding about $60 billion in farmers’ revenue last year.”

One man's loss is another man's gain. Cheap corn will likely buoy the entire meat supply chain through 2016. Expect that topic to be revisited often.